colorado springs vehicle sales tax rate

This rate includes any state county city and local sales taxes. This is the total of state county and city sales tax rates.

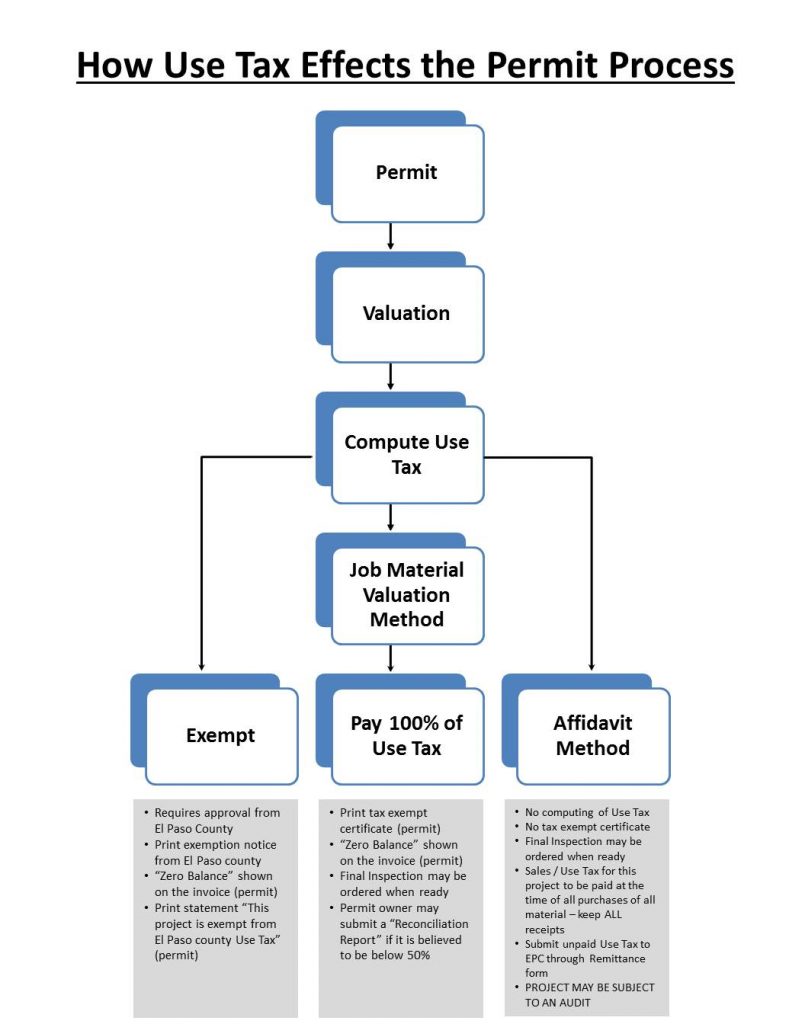

Sales And Use Tax El Paso County Administration

See Department publication Colorado SalesUse Tax Rates DR 1002 for service fee percentages for state-administered local sales taxes.

. The average total car. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

The ownership tax rate is assessed on the original taxable value and year. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state. Sales Tax Rates in the City of Glenwood Springs.

The minimum combined 2021 sales tax rate for Denver Colorado is 881. Motor vehicle dealerships should review the DR 0100 Changes for Dealerships document in addition. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

What is the sales tax rate in Pagosa Springs Colorado. Effective July 1 2022. This is the total of state county and city sales tax rates.

The Colorado sales tax rate is currently 29. This includes the rates on the state county city and special. Sales Use Tax Topics.

The vehicle is principally operated and maintained in Colorado Springs. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs.

Vehicles do not need to be operated in order to be assessed this tax. The minimum combined 2022 sales tax rate for Pagosa Springs Colorado is. What is the sales tax rate in Colorado Springs Colorado.

Average Local State Sales Tax. Maximum Possible Sales Tax. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax.

Owners may be subject to. When purchasing a new. The average cumulative sales tax rate in Colorado Springs Colorado is 781 with a range that spans from 513 to 863.

You can print a 82. The Sales Tax Return DR 0100 changed for the 2020 tax year and subsequent periods. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county.

Ownership tax is in lieu of personal property tax. This is the total of state county and city sales tax. Colorado State Sales Tax.

The latest sales tax rate for Colorado Springs CO. Multiply the vehicle price. Maximum Local Sales Tax.

The following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in effect. A state tax rate of 29 applies to all car sales in Colorado but your total tax rate will include county and local taxes as wellwhich may add up to 8. A county-wide sales tax rate of 123 is applicable to localities in El Paso County in addition to the 29 Colorado sales tax.

How to Calculate Colorado Sales Tax on a Car. Some cities and local governments in El Paso County collect. The minimum is 29.

2020 rates included for use while preparing your income tax. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Taxes And Fees Department Of Revenue Motor Vehicle

Used Cars In Colorado Springs Co Pre Owned Auto Dealer

Used Cars Under 5 000 For Sale In Colorado Springs Co Vehicle Pricing Info Edmunds

Ford Car Service Center In Colorado Springs Phil Long Ford

Why Do I Pay So Many Vehicle Registration Fees In Colorado 9news Com

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Inflation Nation Colorado Springs Residents Pummeled By Rising Prices Subscriber Content Gazette Com

Mercedes Benz Of Colorado Springs New Mercedes Benz Dealership In Colorado Springs Co

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Colorado Springs Cost Of Living Colorado Springs Co Living Expenses Guide

Layers Of Taxation Factor Into Colorado Vehicle Purchases Business Gazette Com

Colorado Springs Auto Bargains Co Springs Used Car Sales

Taxes Fees El Paso County Clerk And Recorder

Ford Car Service Center In Colorado Springs Phil Long Ford

Ballot Issue 7a Extending The Pikes Peak Rural Transportation Authority Colorado Public Radio